PV Power Arbitrage In Negative Tatiff Regions

PV Power Arbitrage allows PV plant operators to avoid selling generated energy immediately at disadvantageously low or even negative market prices. By leveraging BESS technology, excess solar energy is stored during low-price periods and later sold during high-price periods—often at night—maximizing revenue and improving overall project economics.

What Makes PV Power Arbitrage Different?

PV Power Arbitrage ensures PV-generated energy is sold at favorable market prices by leveraging BESS for time shifting. Unlike conventional PV plants that passively feed into the grid—often at low market prices or facing curtailment during negative pricing—BESS integration allows plant owners to shift energy sales to peak-price periods, significantly boosting profitability. The challenge lies in the balance between capital investment and returns through BESS capacity planning—and this is where our expertise delivers real value.

Our Ready-to-Use PV Power Arbitrage Solution:

FFD Power uses smart control and storage to avoid negative pricing losses and turn excess solar into value.

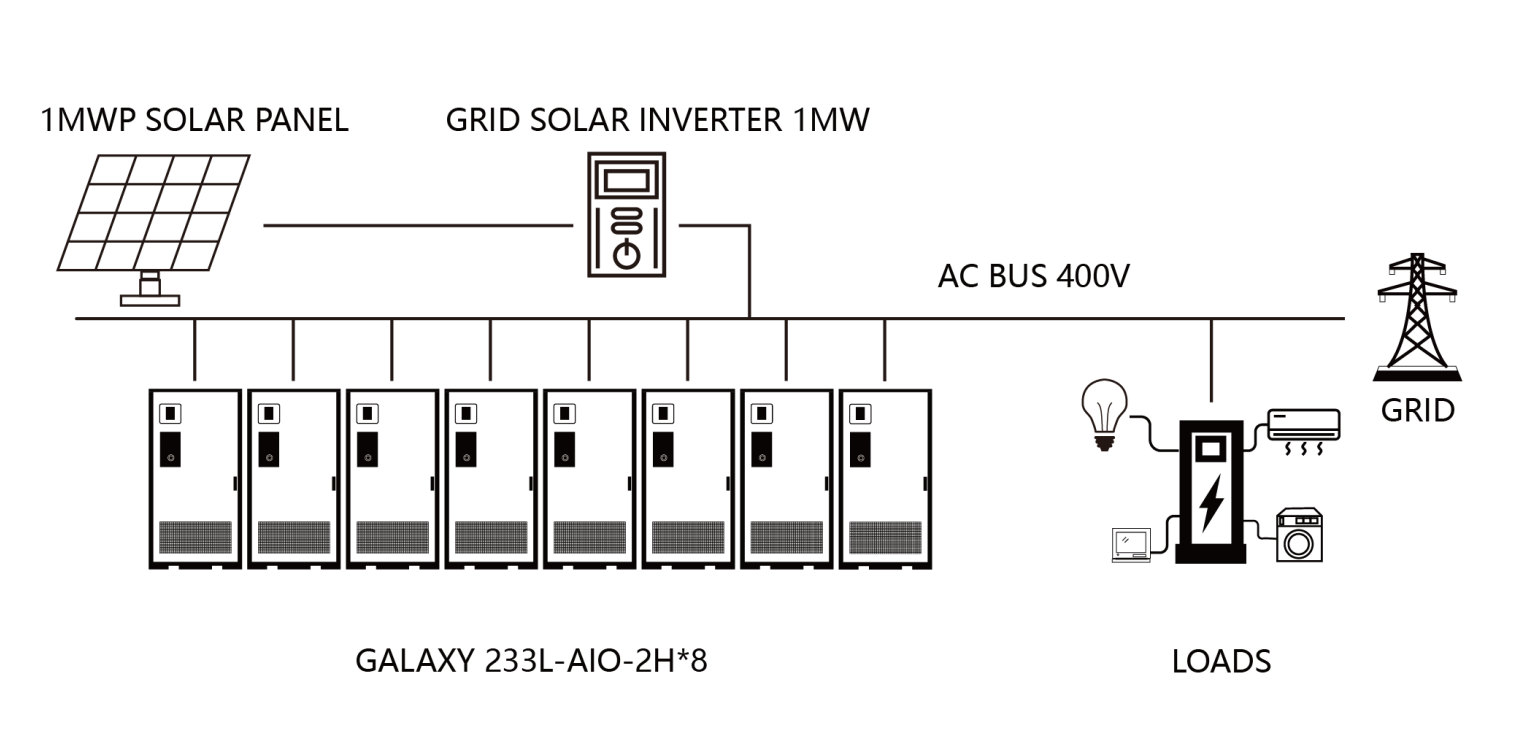

Our PV Power Arbitrage solution combines:

- FFD BESS – the core of energy arbitrage, storing and releasing energy to shift selling hours

- On-Grid PCS – modular, cost-effective all-in-one integration for easy scalability and maintenance

- FFD EMS – intelligent market price analysis and strategy adjustment for optimal performance

This architecture ensures simple installation, reliable operation, and easy maintenance, while significantly increasing energy revenue for PV plant owners.

In addition to core hardware and controls, we provide:

- Tailored BESS capacity planning

- Pre-installed system software

- Complete engineering documentation, detailed project BOM, layout design and connection drawings

- Technician’s onsite commissioning support

- Long-term O&M remote support

This customized design, matched to the PV capacity, ensures precise technical delivery and reliable performance.

FFD Power’s PV Power Arbitrage package is designed to:

- Ensure optimal BESS capacity planning to maximize return on investment

- Increase revenue by shifting energy sales to high-price periods

- Boost profits automatically through smart EMS-driven dispatch

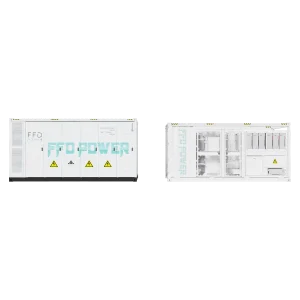

800 Vac Output BESS Option

Native 800 Vac output for transformer-free integration with certain existing PV plants, reducing installation complexity and saving costs. Modular BESS design enables straightforward scalability to meet future capacity requirements.

High BESS Utilization

Capacity planning aligned with PV installation size ensures high usage rates and maximum operational value. This approach delivers the optimal return on investment by balancing performance and cost.

Intelligent EMS

Incorporates market price analysis to plan and adapt energy dispatch strategies in real time. Automatically boosts revenue through optimized charge/discharge scheduling and smart coordination with PV output.

Recommended Products

Case Presentation

0.8MW/1.86MWh Peak Shaving And Valley Filling Project

With the rise of dynamic electricity pricing and growing curtailment risks in regions with negative tariff policies, traditional solar systems face increasing challenges in maintaining profitability. Instead of exporting PV energy during low or negative pricing periods, intelligent energy storage strategies can turn this volatility into a profitable arbitrage opportunity.

This project integrates a 1MW rooftop PV system with an 0.8MW/1.86MWh energy storage system at a large Mediterranean supermarket, delivering a fully off-grid, optimized energy solution for peak shaving, valley filling, and negative tariff arbitrage.

Arbitrage Strategy in Negative Tariff Markets

In this region, negative pricing periods penalize PV systems that inject electricity into the grid. By integrating the PV system with battery storage and predictive EMS control, the project intelligently shifts energy usage, enabling storage of surplus PV during negative tariff hours and discharging it when market prices rebound. This avoids penalty exposure and captures maximum value from solar generation.

Smart Energy Management Across Time-of-Use Periods

The EMS orchestrates dynamic energy dispatch based on real-time load, PV generation, pricing forecasts, and SOC (State of Charge). It enables:

Charging the battery with surplus PV during low or negative tariff hours

Discharging during peak hours to offset high grid costs

Seamless supply transitions to maintain indoor and critical loads

Full Off-Grid Capability with Grid Support Flexibility

Thanks to the integration of 8 units of Galaxy 233L-AIO-2H, the site can operate entirely off-grid, ensuring uninterrupted power for all operations. During system commissioning or emergency scenarios, the solution supports limited grid-connected fallback without export.

Peak Shaving and Valley Filling for Cost Optimization

The system smooths load profiles, reduces peak demand charges, and flattens daily consumption patterns. Energy is charged during low-price periods and discharged during peak, realizing cost-effective arbitrage and improved energy efficiency.

This project showcases how advanced PV-storage integration, coupled with negative pricing-aware EMS algorithms, can transform curtailment and tariff volatility into a profitable, green energy strategy. It also exemplifies how commercial facilities in Europe can achieve grid independence while significantly lowering their energy costs.